$OMC TOKEN

The Ultimate Power Token of OpenMark – Unleashing Three Billion Gamers onto the Blockchain!

Token UTILITY

Liquidity

Token Burns and Deflationary Mechanisms

Governance

Incentives and Rewards

Payments and Transactions

Token Supply & Distribution

The $OMC token has a max supply of 3 billion. This amount is designed to keep the system fair, get people involved, make the network safe, support easy trading, and help it grow over time.

$OMC Token Basics:

Token Name: $OMC

Networks: Works on multiple blockchains

Total Supply: 3,000,000,000

Inflation: Decreasing (deflationary, meaning supply may shrink over time)

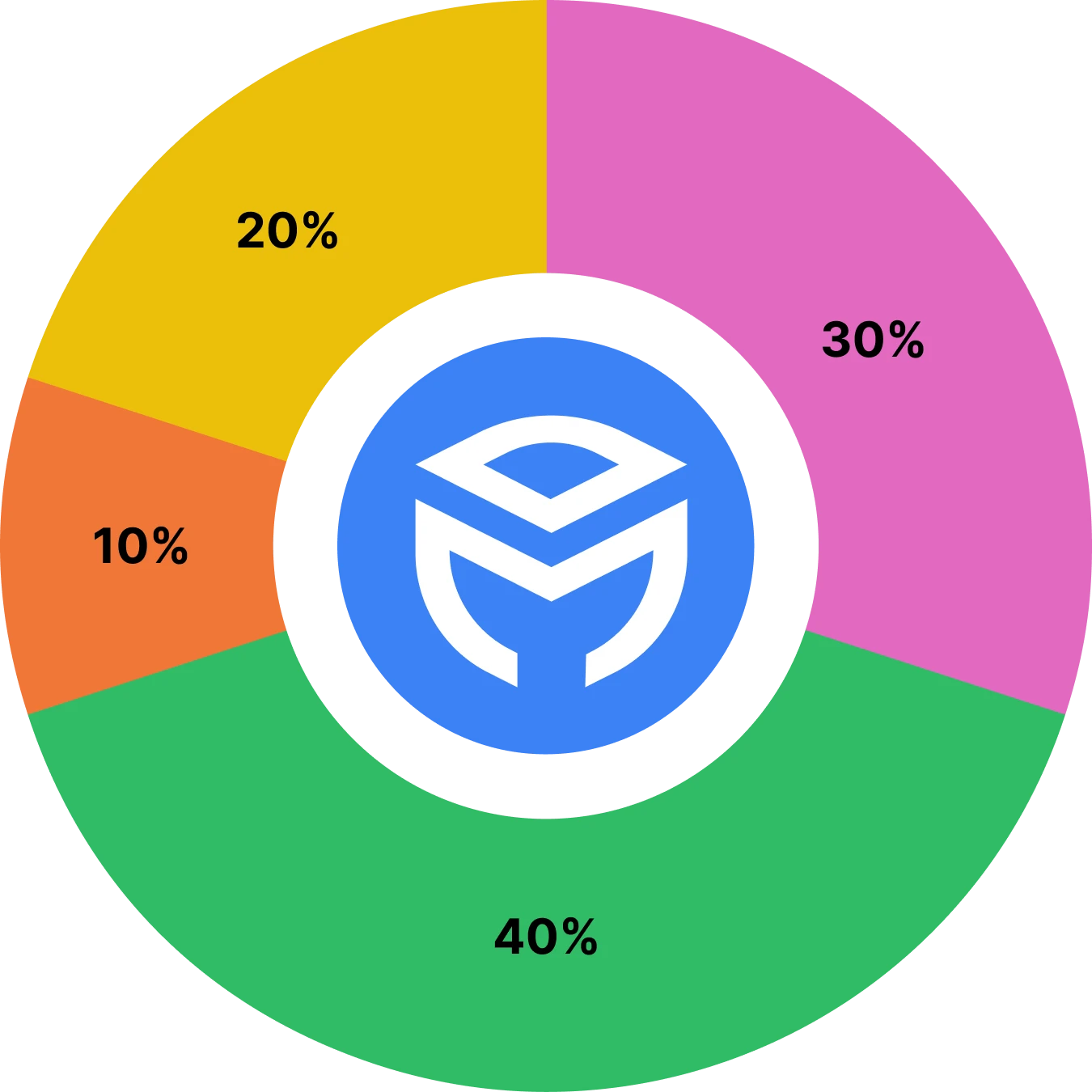

How the Tokens Are Split:

Community & Ecosystem (30%):

This chunk goes to building a strong community and network. It could be used for things like free token giveaways (airdrops), rewards for users, research, teaming up with other projects, or funding new ideas.

Liquidity Reserve (40%):

A big part is saved to make sure $OMC trades easily across different blockchains. It also covers long-term costs like running the system, development, and keeping the project healthy. The foundation manages this to support steady growth.

Core Contributors (10%):

This goes to the early team members who helped build OpenMark from the start.

Early Backers (20%):

These tokens are for the first investors who put money into the project early on. They’re split across two funding rounds, with a lockup period (meaning they can’t sell right away).

Vesting Schedule

Unlocking Over Time

Community

(30% of total supply)

- 30% unlocks right away at the Token Generation Event (TGE).

- The remaining 70% unlocks monthly over 3 years (36 months).

Liquidity Reserve

(40% of total supply)

- 10% unlocks at TGE.

- The remaining 90% unlocks monthly over 3 years (36 months).

Core Contributors

(10% of total supply)

- No tokens unlock for the first year (1-year cliff).

- After 1 year, 30% unlocks.

- The remaining 70% unlocks monthly over the next 2 years (24 months).

Early Backers

(20% of total supply)

- 20% unlocks at TGE.

- The remaining 80% unlocks monthly over 3 years (36 months).